San Francisco, 11 April 2024: The Report Precious Metal Market Size, Share, & Trends Analysis Report By Product (Gold, Silver, PGM), By Application (Jewelry, Industrial, Investment), By Region, And Segment Forecasts, 2023 - 2030

The global precious metal market size is estimated to reach USD 414.57 billion by 2030, according to a new report by Grand View Research, Inc., expanding at a CAGR of 6.8% from 2023 to 2030. Rising demand for precious metals in industrial applications is likely to positively influence the market growth.

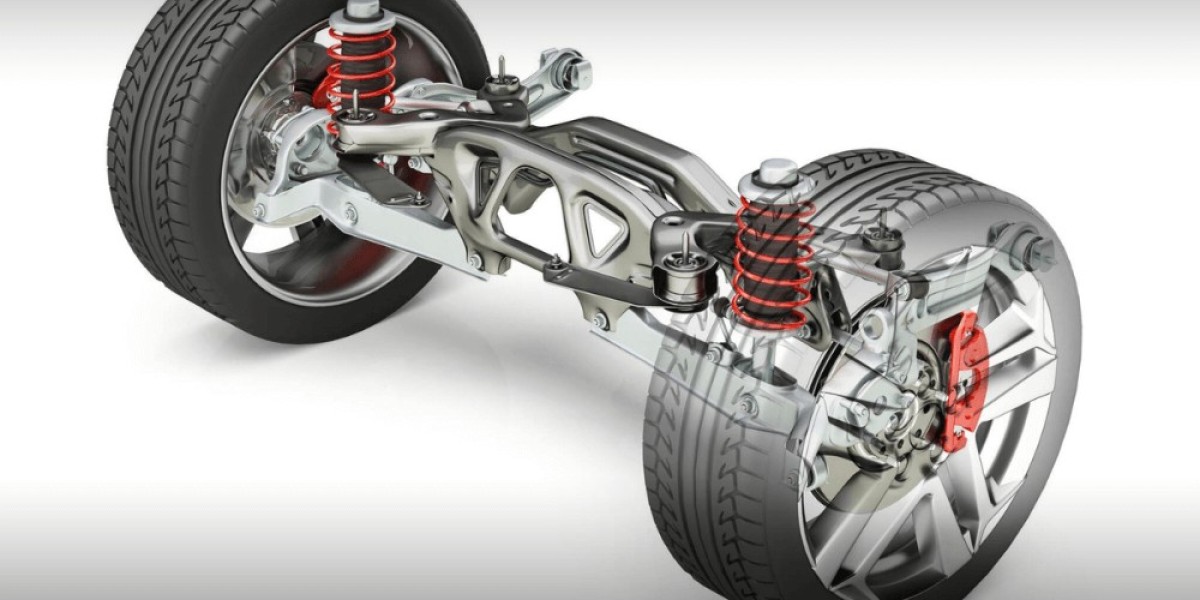

The precious metals including gold, silver, and platinum group metal (PGM) are widely used across various industrial applications. For instance, platinum and palladium are specifically used as an auto catalyst to reduce pollutant emission from vehicles. Similarly, the product is also used as catalyst in the production of chemicals, such as nitric acid and fertilizers. The industrial sector primarily comprises automotive and transportation, chemical, energy, electrical and electronics, glass, and water management. The steady growth in the energy sector owing to rising scrutiny by regulators to promote renewable energy development is likely to augment the product’s growth over the forecast period. For instance, total renewable energy capacity has witnessed steady growth from 2014 to 2018. As per the stats released by the International Renewable Energy Association (IRENA) in 2023, total renewable energy capacity has increased from approximately 1,693.2 gigawatt in 2014 to nearly 2,350.7 gigawatt in 2018.

Another key factor for the market growth is likely to be the jewelry sector. Within the jewelry sector, gold is likely to remain the dominant product segment in future owing to its intense demand from countries, such as India and China. Both countries are among the largest consumers of gold commodity as of 2022 and represents strong marriage rates with high population index. For instance, in 2018, nearly 10.1 million marriages were registered in 2018. Gold, which has remained an intricate part of the marriages in India and China largely due to its historical significance, is thus likely to remain a key product category within the market of precious metals.

The industry comprises multinational vendors,along with few regional vendors. Industry participants are forming joint ventures to target development activities in African countries, wherein majority of precious metal reserves are located.

Demand for the product in jewelry application is likely to emerge as an influential factor for the industry growth over the forecast period. The use of gold, specifically in the jewelry industry, is projected to witness steady growth over the coming years. The commodity of gold has been an internal part of marriages, especially in India and China, wherein a significant amount of product is used in the form of jewelry and ornaments. For instance, India's wedding space observed nearly 2.5 million marriages annually with a total market estimation of more than USD 40.27 billion in 2021. Similarly, China's marriage space witnessed nearly 6.83 million marriage registrations in 2022. The wedding market space of China and India is thus likely to present numerous growth opportunities for the gold jewelry market segment over the coming years.

Request sample report of Precious Metal Market@ https://www.grandviewresearch.com/industry-analysis/precious-metals-market/request/rs1

In the U.S., the total production of precious metals was evaluated at around 1,195.6 tons as per the stats released by the United States Geological Survey (USGS) in 2020. Within this category, gold production reached nearly 200 tons in 2023, and approximately 15.6 tons for platinum group metals (PGM). PGM resources were mined in Montana by Sibanye-Stillwater, which is the sole producer of PGM in the U.S.

Precious Metal Market Report Highlights

- Gold is expected to remain the dominant product segment in terms of revenue in the years to come. Growing prices of the commodity due to global pandemic is likely to aid the segment growth over the forecast period

- The silver segment is projected to grow at a CAGR of 2.7% over the forecast period. The intense use of the product in the electrical and electronics sector is likely to promote its growth over the projected period

- The industrial application segment is projected to remain the dominant segment in terms of volume as well as revenue over the forecast period. Rising scrutiny to reduce vehicle pollutant emission by regulators around the globe is projected to remain a key driver for the segment

- The investment application segment is expected to witness the highest growth in terms of volume over the forecast period. The segment is primarily driven by countries like Russia and Kyrgyzstan. Both country’s central bank is buying the highest stock of gold commodities over the last seven years. For instance, in 2023, central bank of the country brought nearly 149 tons of gold commodity in first 11 months

- Asia Pacific is projected to remain the dominant regional market in the years to come. In an optimistic scenario, India and China are projected to continue their growth trajectories post corona situation, and thereby likely to remain key gold consuming countries over the forecast period.

The jewelry sector accounted for a key share of the U.S. precious metals industry while capturing nearly 40% share in terms of volume as of 2023. The concentration of gold jewelry vendors in the states of New York, Rhode Island, California, Texas, and Florida consumed nearly 50% of the product demand in 2023.

In December 2022, there was a slight recovery in precious metal prices, but they remained significantly below their March 2022 highs. Rising interest rates and a strong U.S. dollar are prevailing factors that outweighed gold demand. Gold prices were negatively affected by soft consumer and investment demand, but robust central bank purchases offered some support. On the other hand, silver prices were hampered by weak industrial demand, while platinum prices rebounded more strongly, reflecting a recovery in autocatalyst demand and supply challenges.

The gold segment accounted for the largest revenue share of 82.3% in 2022 due to its high trading prices and greater usage in the jewelry sector. The gold production for 11 years is witnessing continuous growth with new mines commissioned in 2023. Among these, the Meliadine mine by Agnico Eagle Mines Ltd. and Gruyere mine by Gold Fields Ltd., and Gold Road Resources Ltd. were planning to add a major chunk of the new production. Thus, new product additions are likely to further aid the demand trend of the commodity over the coming years.

Precious Metal Market Report Scope

Report Attribute | Details |

Market size value in 2023 | USD 262.24 billion |

Revenue forecast in 2030 | USD 414.57 billion |

Growth Rate | CAGR of 6.8% from 2023 to 2030 |

Base year for estimation | 2022 |

Historical data | 2018 - 2021 |

Forecast period | 2023 - 2030 |

The silver segment is projected to grow at a CAGR of 2.7% over the forecast period. The market is segmented into gold, silver, and platinum group metals (PGM). Silver is likely to grow steadily over the forecast period owing to its wide usage across the industrial and jewelry sector, coupled with low cost as compared to its counterparts. Mexico and Peru are projected to remain the key production hubs for silver commodities. According to the United States Geological Survey, Mexico’s silver production was 6,300 metric tons, followed by Peru at 3,100 metric tons as of December 2022. Other key producing nations are Russia, China, Australia, and Chile.

The PGM product segment is likely to witness sluggish growth as compared to its counterparts over the forecast period. The downturn in automotive vehicle manufacturing is already impacting the demand traits of platinum and palladium.

List of Key Players of Precious Metal Market

- Freeport-McMoRan

- Polyus

- Newmont Corporation

- Gold Fields Limited

- Randgold & Exploration Company Limited

- Barrick Gold

- AnglogoldAshanti

- Kinross Gold Corporation

- Newcrest Mining Limited